The cheap sr22 insurance near me blog 7531

What Does Cheap Sr-22 Insurance Chicago And Chicagoland Area Do?

At Breathe Easy Insurance coverage, we can aid you find the most effective possible prices on non-owner car insurance coverage to save you the optimum quantity of money. For a cost-free quote on non-owner insurance coverage and also SR22 from Relax Insurance policy, request a quote online or call us today at 833 (insurance). 786.0237 (insurance).

SR-22 Insurance can just be acquired via an insurance policy service provider (credit score). SR-22 insurance has a considerable impact on your prices in The golden state, as well as those rates can differ considerably from one business to an additional. Limitations for An SR-22 Insurance Policy in The golden state At the minimum, you require the protection provided below if you are required to have SR-22 insurance in The golden state (vehicle insurance).

The very same instance relates to those that do not have a lorry. dui. Non-owner automobile insurance policy is the perfect alternative for those that do not own an automobile since common auto insurance policy can be pricey. bureau of motor vehicles. That suggests that such individuals will be covered in case of another crash, as well as they can additionally show evidence of liability insurance policy coverage to obtain their permit reinstated. sr22 insurance.

The reason non-owner SR-22 insurance coverage is more affordable is that the insurance firm thinks that you do not drive often, and also the only protection you obtain, in this case, is for responsibility just - dui. If you rent out or borrow cars often, you must consider non-owner automobile insurance too (credit score). Although prices can differ across insurance providers, the typical yearly cost for non-owner cars and truck insurance in The golden state stands at $932.

The Ultimate Guide To Cheapest Sr22 Insurance Arizona Az Non Owner Near Me

Demands for An SR-22 in The golden state First, comprehend that an SR-22 impacts your cars and truck insurance policy expense and also coverage (department of motor vehicles). After a DUI conviction in The golden state, conventional drivers pay an average of 166% more than vehicle coverage for SR-22 insurance coverage. The minimal period for having an SR-22 in California is 3 years, yet one may require it longer than that, depending upon their instance and offense.

In any one of these scenarios, an SR-26 form can be filed by your insurer. When that happens, your insurance firm should show that you no more have insurance coverage with the entity. Beginning the SR-22 process over once again will be necessary if your firm files an SR-26 prior to finishing your SR-22 need. division of motor vehicles.

MIS-Insurance deals affordable SR22 insurance coverage that will conserve you cash over the life of your plan. Economical SR22 insurance policy is readily available as well as we will can help you secure the right policy for you - dui. The reason is that each insurance firm uses its criteria when evaluating your driving background. On the other hand, California regulation bans companies from enhancing rates or terminating your policy in the center of its term.

A DUI will instantly raise your rates without thinking about added rate increases and deny you price cuts even if you were previously getting an excellent chauffeur discount rate. Instead of paying $100 monthly for cars and truck insurance policy, a motorist with no DUI history will only pay $80 month-to-month, many thanks to the 20% good chauffeur price cut they get. bureau of motor vehicles.

Some Known Incorrect Statements About Free Texas Sr22 Filing - Abc Insurance Services

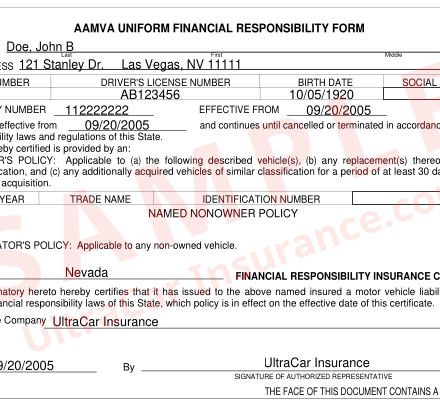

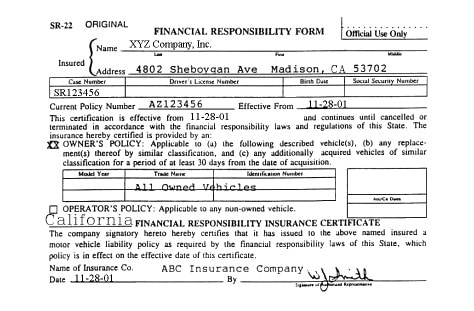

What you require to understand about SR-22 Filing in The golden state When it pertains to issues concerning automobile insurance, our driving records, and civil liberties as well as opportunities, in some cases we are instructed things that simply are not real. department of motor vehicles. Allow's look at a few of the most common myths and also misunderstandings relating to the SR-22 California: What is the SR-22 Chauffeur Filing? An SR-22 is a certification of insurance filed by your insurer directly to the Department of Electric Motor Automobiles - sr22 coverage.

SR-22 Minimum Obligation Limits The minimum obligation restrictions have to fulfill your state's needs. All you have to do is request your insurance policy firm to submit an SR-22 for you, then the insurance policy business takes care of the remainder.

https://www.youtube.com/embed/VtDVj66hnjE

Stay Clear Of Future SR-22 Terminations and Suspensions Once you have your SR-22 coverage, you desire to make certain it does not obtain terminated or put on hold - no-fault insurance. The earlier you renew it, the safer you'll be as well as the much less likely your SR-22 will certainly be cancelled - coverage.

Not known Details About Sr22 Insurance

At Highway Insurance policy, we can help you make the right choices while giving you with car insurance policy alternatives that are lasting.

An SR-22 isn't actually vehicle insurance coverage. SR-22 is a type your insurance business sends out to the state's DMV revealing that you carry the minimum necessary Liability insurance coverage. Normally, an SR-22 is submitted with the state for 3 years.

Who Demands SR-22 Insurance Coverage in California? Not every vehicle driver requires to submit an SR-22 Form in California.

You can opt-out of purchasing these insurance policy protections so long as you state your rejection in writing. At the very the very least, you need to meet the responsibility insurance coverage demands in California. Everything else is optional, but it is very recommended that you purchase full coverage for on your own and also your lorry.

How Lengthy Will You Required SR-22 Insurance Policy in California? On standard, many violations in California need you to keep SR-22 insurance policy for 3 years.

The smart Trick of Suspended Driver's License? You May Need An Sr-22 - State ... That Nobody is Talking About

It must also be noted that when your permit is revoked or suspended for a duration of time, the SR-22 insurance policy requirement begins after that. You need to not let your insurance protection gap throughout your SR-22 insurance demand period. division of motor vehicles.

You will certainly likewise have to go with the SR-22 declaring procedure once more. Attempting to get insurance coverage after a lapse in protection can be tough, specifically when you require an SR-22 plan contributed to your cars and truck insurance policy. If you vacate California during your SR-22 insurance coverage duration, you will certainly need to find an insurer that does organization in both California and also the state you are preparing to relocate to.

As soon as your required filing period mores than, you will certainly get free reign of your vehicle insurance coverage choices. How Much Does SR-22 Insurance Cost in California? In The golden state, the average cost of SR-22 insurance policy protection is around $1,600 each year. However insurance coverage prices can depend a great deal on your sentence. Being founded guilty of a DUI can elevate your prices significantly, with some policies being virtually triple what the ordinary SR-22 plan as well as insurance policy protection prices each year.

Several insurance coverage business bill a declaring cost of anywhere from $25-$50. In California, insurance firms can not boost your insurance coverage prices or cancel your insurance coverage policy in the center of its term.

California automobile insurance policy regulations likewise prohibit insurance coverage business from using excellent motorist policy discount rates to any person with a DUI for 10 years following the sentence. Nevertheless, there are other cars and truck insurance policy discount rates you can still get in The golden state if you have a DUI, like multi-policy or bundling discount rates. But losing an excellent driver policy discount rate can be damaging to your insurance coverage rates as it can be the most impactful insurance discount a business supplies.

The Only Guide to How Much Does Sr22 Insurance Cost?

A non-owner policy can offer you with the obligation insurance coverage needed in California as well as will certainly guarantee you are protected must you finish up in one more traffic case. It is additionally a more affordable sort of coverage when you compare it to traditional auto insurance policy. However do not consider this sort of insurance policy even if it is regarded fairly inexpensive insurance coverage.

As an example, if you are an university student living at home and also have access to your parent's car, you will certainly not qualify for a non-owner insurance plan. This sort of plan would certainly be ideal to get if you frequently rent out automobiles. Everybody needs the proper insurance coverage when behind the wheel (sr22 coverage).

DUI Convictions in California, A DUI conviction is among the most major web traffic offenses (driver's license). Also if it is your initial violation, you will have boosted cars and truck insurance prices in addition to fulfilling an SR-22 insurance coverage need to reactivate your license after a DUI.Car insurance coverage is not the only location you have to stress around adhering to a DUI sentence.

Including what is detailed in the graph below, you will certainly additionally need to pay a $125 enrollment cost as well as a $15 certificate reprinting fee after a DUI.

An SR-22, commonly referred to as SR-22 insurance policy, is a certification issued by your auto insurer offering evidence that you bring the called for minimum quantity of automobile liability protection for your state. bureau of motor vehicles. If you have been associated with an accident as well as were not lugging minimal cars and truck insurance policy, many state DMVs will require you to submit an SR-22.

The 10-Second Trick For Suspended Driver's License? You May Need An Sr-22 - State ...

If a vehicle driver is needed to carry SR-22 as well as she or he transfers to one of these 6 states, they should still remain to satisfy the needs legally mandated by their former state. All automobiles in Washington and also Oregon have to bring a minimal responsibility insurance coverage - insurance. If a Washington chauffeur has his/her license put on hold, the chauffeur should offer evidence of economic responsibility by submitting an SR22.

It is very recommended that the insured renew their plan a minimum of forty-five (45) days in advance (deductibles). There are two (2) ways to avoid having to obtain an SR-22 Washington endorsement. A motorist can make a deposit of $60,000 to the State Treasurer or obtain a surety bond via a guaranty company such as Vern Fonk that is certified to do business in Washington and also Oregon.

A driver can not merely show his insurance policy card as proof. The insurance policy card will certainly be called for by Oregon law, to be existing in an automobile that is operated Oregon freeways. insure. The DMV carefully checks compliance with SR22 needs, and if the insurance coverage gaps, the insurer by law is needed to alert the DMV of that truth and also the vehicle driver's license will certainly be put on hold.

If your SR22 automobile insurance coverage is cancelled, gaps or expires, your auto insurance coverage business is needed to alert the authorities in your state. (They do this by releasing an SR26 form, which licenses the termination of the plan.) At that point, your license could be put on hold once more or the state may take other significant activities that will certainly limit your capacity to drive.

Failure to keep your insurance coverage might cause you to shed your driving opportunities once again and your state might take other activities versus you. It's finest to maintain the SR22 for the entire mandated time period. State regulations regarding SR22 car insurance policy demands can be complicated (car insurance). That's why it's so vital to get trusted details and also support from certified insurance coverage representatives at respectable SR22 insurer.

The Buzz on Sr-22 Insurance Cost - Magnum Insurance

And also, experienced agents will be able to aid you discover an approved affordable SR22 insurance policy.

As a risky motorist, you may have more to take care of than just locating insurance policy protection. Along with your automobile policy, you may also need SR-22 insurance coverage in Colorado. While all of these policies might appear complicated, our group at Select Insurance coverage Group can help you navigate the SR-22 needs and also answer your concerns regarding the policies you need.

You should have SR-22 insurance to get your license restored. You generally need to maintain your SR-22 active for 3 years. If the certification becomes non-active throughout any part of those 3 years, you'll need to obtain a new SR-22 as well as start the three-year duration once more. The SR-22 is not an insurance plan itself instead, it reveals that you can pay for insurance policy. sr22.

Remember SR-22 certificate expenses remain in enhancement to the prices you will spend for your normal vehicle insurance coverage - sr-22.

THE LENGTH OF TIME IS AN SR-22 VALID? Each state has its very own demands for the length of time that an SR-22 must remain in area (underinsured). As long as you pay the necessary costs and to maintain your policy energetic, the SR-22 will continue to be basically till the needs for your state have actually been fulfilled.

The Single Strategy To Use For Colorado Sr22 Insurance - Sr22 Quotes

WHAT IS THE DIFFERENCE IN BETWEEN AN SR-22 AS WELL AS AN FR-44? A lot of states need a little filing cost when an SR-22 is very first filed.

At Safe, Auto, we recognize that purchasing vehicle insurance coverage can be stressful and costly. You can call a devoted Safe, Automobile customer support rep at 1-800-SAFEAUTO (1-800-723-3288) to ask for an SR-22 be filed. insurance group.

You do not require to have a car to buy this kind of insurance. If you do not possess an auto, ask your insurance provider about a non-owner SR-22 policy. For most offenses, you need to carry this sort of insurance coverage for three years from the ending day of any type of retraction.

Obtain in touch with your insurance service provider to discover out your state's existing requirements as well as make certain you have adequate protection. Just how long do you require an SR-22? Many states require vehicle drivers to have an SR-22to prove they have insurancefor about 3 years.

(Mon-Fri, 8am 5pm PST) for a or submit this kind: three to five times greater than the typical figures if your chauffeur's permit has been put on hold or withdrawed. While the price of getting the SR22 certification is irrelevant (in the variety of $25 or much less), the real costs you will certainly need to pay rely on the seriousness of the violation and the risk you presently position to the insurance company.

The smart Trick of Sr-22 Virginia - Bankrate That Nobody is Talking About

A 19 years of age driver with a DUI sentence could or may not pay more than a 40 years of age one with the very same sentence - ignition interlock. Despite the fact that teenage vehicle drivers are typically billed more, it might be that the senior vehicle driver has a more expensive auto, a careless driving history, even more than one cars and truck or more vehicle drivers on the very same plan.

The costs decrease as you come close to 40 as well as have a tendency to go back up when you remain in your late fifties. It do without claiming that the much more expensive the vehicle is, the more it will cost to insure it. Variables like leading speed and also 0-60mph time are taken into account as well, so a sports car will certainly be extra pricey to insure than a limo in the very same cost variety.

A driver with a pristine record will certainly pay much less than one that submits a case every various other month. Taking a protective driving course could make you score better. The severity of the violation that bring about the SR22 requirement is additionally to be thought about DUI's are considered much more serious than getting many speeding tickets in a short period of time.

https://www.youtube.com/embed/_3a81HRSoOk

Given that rates for routine protection vary from one insurer to another, you can just visualize just how much money you can save from shopping around. (Mon-Fri, 8am 5pm PST) for a or fill up out this kind:.

Some Known Incorrect Statements About Financial Responsibility Affidavits - Tn.gov

For the most part this implies your insurance provider validated insurance coverage with the DMV, as well as nothing more is required. You may lawfully drive the car if the registration is or else valid. Utilize the Insurance Coverage as well as Registration Status Questions to be certain. What is an SR22? Exactly how does this connect to an insurance reinstatement? "SR-22 Insurance coverage" is a Certificate of Financial Duty that your insurance firm will submit with the DMV.

The penalty for the lapse of insurance policy may still apply. I will be car park my lorry and also might obtain "garage" insurance policy. Garage insurance is NOT responsibility insurance policy, as well as consequently is not appropriate or reported to the DMV.

If you go down the responsibility insurance policy for any type of reason, you must terminate the Learn more registration and surrender the license plates. NVLIVE confirmation uses just to responsibility insurance. See License Plate Surrender. Please check with your insurance coverage representative to validate whether you have obligation protection. I'm having a disagreement with my insurance coverage company/agent.

This evidence is either a Certificate of Insurance coverage (recognized as an SR-22) from any kind of insurer certified to conduct business in Arizona, or a certificate from the Arizona Office of Treasurer showing deposit in cash money or deposit slips of $40,000. For the revocations as well as suspensions, you are called for to maintain proof for 3 years from the date you end up being eligible for reinstatement.

If you have inquiries, please call MVD (underinsured).

All About Financial Responsibility Insurance Certificates (Sr-22)

When you have actually successfully completed the mandated amount of time, an SR22 is also required in order to have your certificate and also your driving privileges totally reinstated. insurance group. Since we understand what SR22 insurance policy is, allow's take a closer check out why someone would certainly require it: SR22 insurance policy is needed for numerous different factors: If you have actually been caught driving without a valid insurance coverage If you are caught driving under the influence or while intoxicated If you are caught driving without a license or with an ended one If you have way too many traffic tickets in a short time structure These listed are one of the most frequent reasons for the requirement.

If you don't possess a lorry or utilize one on a frequent basis, the much more proper type for you would be the non-owners SR-22. Getting an SR22 can seem difficult and also terrifying, however it really does not need to be. There are couple of easy steps that are up to you the remainder remains in the hand of the insurance provider or the agent.

If you choose not to select that company, or if that company does not use SR22 insurance, you then require to discover an alternative alternative. It is up to you whether youll make an online insurance acquisition, or call a representative directly. Dealing directly with a representative serves as you have the ability to obtain a precise price faster. ignition interlock.

auto insurance ignition interlock insure insure no-fault insurance

auto insurance ignition interlock insure insure no-fault insurance

You might not learn exactly what the charge is till the plan is acquired. To buy the insurance policy, you will merely need to respond to a series of questions as well as pay a cost. The insurance provider will certainly then complete and submit the certification in your place. Well, unfortunately, SR22 insurance coverage overall, is not affordable at all.

You probably have court expenses as well as legal representatives charges to pay in addition to a boost in your automobile responsibility costs because you are currently taken into consideration a high-risk driver (deductibles). You will definitely be paying more than the average driver. If you are trying to find the ideal prices for SR22 insurance policy in California, call our professionals at Breathe Easy Insurance policy today.

Indicators on Faqs: Answers To Common Questions Related To Sr22 Insurance You Need To Know

If 5 years pass from the date of suspension before you restore your benefits, after that the SR-22 would certainly not be called for. If the SR-22 is cancelled before the required time and also a new type not filed, your driving advantages will be put on hold.

Nevertheless, if the automobile is not covered by accident and also extensive coverage, just make certain you can pay for to change the vehicle if a crash happens. dui. Other methods to save money on your costs so you take advantage of affordable SR22 insurance policy is by deciding for a higher insurance deductible. Your monthly rate is reduced when you select a high insurance deductible, however you'll have to pay more out-of-pocket if you remain in an accident.

dui dui driver's license liability insurance no-fault insurance

dui dui driver's license liability insurance no-fault insurance

If you're someone who has actually just recently been founded guilty of website traffic offenses, including a DUI, careless driving, or driving without insurance, it's most likely you're mosting likely to call for an SR22. This begs the inquiry, exactly what is SR22 insurance coverage, and also what is it utilized for? An SR22 is an incredibly essential document for those that have a history of driving-related offenses - liability insurance.

It can commonly be acquired along with the vehicle insurance protection you select. This means you'll be paying higher insurance coverage premiums for your cars and truck than someone without any crashes or violations on their document, and also it will limit your option in insurance companies.

bureau of motor vehicles vehicle insurance insurance companies sr22 deductibles

bureau of motor vehicles vehicle insurance insurance companies sr22 deductibles

There are many questions motorists end up having concerning SR22s, in addition to a variety of various other information they must be mindful of if they occur to call for one. sr-22 insurance. Learn better as we discuss what you should find out about how these filings work, why you may need one, just how to locate budget friendly SR22s and more in our write-up below.

The 3-Minute Rule for Sr-22/sr26 Financial Responsibility Certification - Virginia ...

In fact, SR22s don't elevate the rate of your insurance. You will in some cases hear an SR22 referred to as SR22 insurance coverage, which puzzles numerous individuals right into assuming it's a specific kind of insurance coverage.

The SR22 is simply a paper verifying that your insurance provider guarantees you are carrying the correct protection legally mandated by the court to a state's DMV. You will certainly have the necessary auto insurance coverage in addition to the SR22. The state needs to be unbelievably thorough when it comes to controling which drivers must not be permitted back out on the roadway, especially with infractions such as driving under the influence, without insurance, or recklessly to the point of endangerment.

A DUI sentence is another reason, as we stated previously. Getting into an automobile accident while uninsured is also a typical reason for an SR22. bureau of motor vehicles. If you remain in an accident and you have no coverage, you will not be able to effectively cover any type of problems or injuries to the various other driver and also their automobile.

These factors are included in your motorist's permit after each significant offense you have actually had. The DMV and also your automobile insurer will keep an eye on the amount of offenses you have as well as if you have actually become a liability when driving. If you are termed as a continuous website traffic culprit, you may also require the SR22 to get your certificate restored. sr22 coverage.

While SR22s will obtain you back when traveling quicker, you ought to remember it will be costly. auto insurance. How You Can Get an SR22 You can get your SR22 from an insurer, however you'll have to get the vehicle coverage initially. The purpose of the form is to reveal that you've obtained as well as will maintain particular insurance protection.

The 15-Second Trick For Financial Responsibility (Sr-22) - Dol.wa.gov

The SR-22 declaring would certainly be a vital action to your license back if your driving privileges were revoked. To submit the kind, initially, take it to your car insurance provider as well as have them finish their portion of the documents. Once they have actually done so, acquisition at the very least the needed quantity of liability insurance coverage for the particular quantity of time mandated by the state division, which is typically a three-year period.

This will certainly show that you have insurance policy protection and also limits mandated by law. You will receive your own copy you can make use of as evidence of verification. If needed, most states store this digitally in their documents so it can be searched for swiftly when needed by the Division of Motor Autos (insure).

What is SR22 Non-owner Cars And Truck Insurance Coverage? The non-owner certificate will certainly cover you if you require an SR222 yet do not own a car - bureau of motor vehicles.

What is The Cost of SR22 Insurance? An SR22 can set you back vehicle drivers a whole lot in terms of insurance policy rates, however have you ever before asked yourself just how much it would really take to cover a year's worth?

sr22 sr22 liability insurance deductibles auto insurance

sr22 sr22 liability insurance deductibles auto insurance

SR22 Insurance Policy Costs in Various States While you can obtain a harsh estimate of what SR22s expense, it will be determined by the state you stay in. This is why it's practical to have a concept of what they set you back from state to state. For instance, in Illinois, you have a typical insurance policy coverage expense of $1,176, which increases to $2,217.

The 5-Second Trick For Financial Responsibility Insurance Certificates (Sr-22)

If you're in a state such as Wisconsin, you'll see a 56% boost of $1,784 from $1,147, just a $647 distinction (ignition interlock). You can go on the internet to all states as well as their prices when an SR22 is added. Will my Insurance Policy Fees Decrease When I No Longer Have to Bring SR22 Insurance? It is not assured that your prices will certainly go down after you are no longer needed to bring an SR-22, but it may take a while for them to return.

For DUI convictions, your price might never ever return down again and can become worse depending upon various other website traffic offenses in the meantime - insurance. The length of time am I Needed to Have an SR22? You would be needed to keep an SR-22 in many states for three years, with the duration differing from one to five years.

You must also be mindful that the begin date as well as how much time you require to carry an SR-22 varies by state, so it aids to call the Division of Electric Motor Autos in your certain state to discover out when it begins from. If you terminate your SR22 insurance prior to the filing period is up, you'll be facing penalties from the state - underinsured.

You do not want the state to withdraw your vehicle driver's certificate or your automobile's registration, which is the exact method they'll punish you for this. What Occurs If I Don't Have SR22 Coverage? The state Department of Electric motor Cars will be alerted by your insurance business if you don't have the proper insurance protection required for an SR22.

insurance vehicle insurance underinsured sr22 coverage coverage

insurance vehicle insurance underinsured sr22 coverage coverage

In enhancement, you might need to pay penalties and fines relying on the state law. Constantly ensure you're up-to-date on your insurance coverage payments, so if you slipped up as well as failed to pay the revival charge for your plan in time, you'll require to contact the supplier of your cars and truck insurance coverage asap to obtain this looked after (insurance coverage).

10 Things You Need To Know About Insurance Form Sr-22 ... Can Be Fun For Anyone

https://www.youtube.com/embed/qFd_05WiNmcYou ought to obtain quotes from a range of insurance provider as well as compare them. Remember as well that you may need to take a look at many car insurer before you discover what's ideal for you. The more vehicle insurer you check, the more probable you'll find the most effective prices for you.

How Top 10 Cheap Sr22 Insurance Wisconsin Answers can Save You Time, Stress, and Money.

The reason that non-owner SR-22 insurance policy is less costly is that the insurance firm thinks that you do not drive often, and the only coverage you get, in this situation, is for liability just (dui). If you rent or borrow cars frequently, you ought to consider non-owner car insurance policy too. Although prices can vary throughout insurance companies, the average annual price for non-owner cars and truck insurance policy in The golden state stands at $932.

Needs for An SR-22 in The golden state First, understand that an SR-22 influences your vehicle insurance coverage cost and also insurance coverage. After a DUI sentence in The golden state, basic vehicle drivers pay an average of 166% more than cars and truck coverage for SR-22 insurance coverage. dui. The minimal period for having an SR-22 in The golden state is 3 years, yet one might require it longer than that, relying on their instance and also infraction. department of motor vehicles.

In any one of these scenarios, an SR-26 form can be submitted by your insurance provider (sr-22). When that occurs, your insurer needs to suggest that you no more have insurance policy protection with the entity. Starting the SR-22 process over again will certainly be necessary if your company files an SR-26 before finishing your SR-22 need.

MIS-Insurance offers cheap SR22 insurance that will conserve you money over the life of your policy. Budget friendly SR22 insurance policy is available and also we will certainly can assist you safeguard the right plan for you - coverage.

How Modesto Stolen Cars This Derrel's Location Offers Low-cost Self ... can Save You Time, Stress, and Money.

A drunk driving will immediately increase your prices without thinking about extra rate increases as well as reject you discount rates even if you were formerly obtaining an excellent chauffeur price cut. ignition interlock. For instance, rather than paying $100 month-to-month for auto insurance coverage, a driver with no DUI history will just pay Learn here $80 month-to-month, many thanks to the 20% great motorist discount they get - sr-22 insurance.

Searching for an SR22 insurance policy overview that makes the truths clear? Inexpensive SR22 quotes are hard ahead by because the SR22 only applies to a very small portion of chauffeurs. Chauffeurs who have actually been found accountable for a severe website traffic infraction are marked "high threat" and needed to hold the SR22 as a problem of proceeding to drive (sr-22).

At Economical Insurance policy, we comprehend just exactly how important it is to locate low-cost SR22 quotes. The best quote can save you hundreds of dollars a year, particularly because SR22 can be really costly. underinsured. Our group is right here to aid so below are the leading questions on SR22 insurance coverage and also their answers - underinsured.

car insurance auto insurance vehicle insurance sr-22 insurance companies

car insurance auto insurance vehicle insurance sr-22 insurance companies

credit score auto insurance sr22 car insurance ignition interlock

credit score auto insurance sr22 car insurance ignition interlock

Numerous smaller sized business do not supply it, or provide it just at really high prices. Still, you need to get SR22 cars and truck insurance policy as quickly as feasible and also make sure you have your auto insurance policy card convenient whenever you drive.

Little Known Facts About Cheap Sr-22 Insurance - Youtube.

You may require to request low-cost SR22 quotes from lots of various providers prior to you locate one that is truly budget friendly - motor vehicle safety. Who Is Required To Have SR22? No SR22 insurance guide would certainly be complete without discussing that is in fact called for to hold it. The SR22 automobile insurance recommendation is typical for: Vehicle drivers convicted of Driving While Intoxicated (DWI) or Driving Intoxicated (DUI) Any Individual that has actually been located in charge of a major car offense, such as a hit and run, People who take part in duplicated traffic offenses, also if individual cases are small, Drivers discovered to be without insurance or under insured at the time of a mishap they caused, Any person who has had their driving benefits suspended momentarily because of a court order.

People all over the country have run the risk of driving without insurance as well as obtained into a mishap, only to locate that they pay 2 or 3 times as high as they would certainly have for a common car insurance coverage. And also, without vehicle insurance coverage you are not shielded from responsibilities developing from an accident - coverage.

In "no fault" auto insurance states, stopping working to hold Individual Injury Security (PIP) insurance suggests you will certainly not have any insurance coverage for your medical bills, lost incomes, and other accident prices. If you fail to get SR22 after being ordered to do so, charges are really serious as well as can even include jail time. insurance companies.

credit score vehicle insurance sr-22 insurance department of motor vehicles department of motor vehicles

credit score vehicle insurance sr-22 insurance department of motor vehicles department of motor vehicles

Courts typically have broad freedom to impose the SR22 limitation and also to eliminate it. That stated, you will normally be needed to hold it for regarding 3 years from the date of sentence or from the day of the certifying accident - ignition interlock. Numerous states obtain a notice straight from the insurance firm if you close your auto insurance plan or fail to pay and shed your protection.

The Basic Principles Of Cheap Sr 22 Auto Insurance In Missouri - Money Beagle

insurance companies insurance companies liability insurance department of motor vehicles motor vehicle safety

insurance companies insurance companies liability insurance department of motor vehicles motor vehicle safety

auto insurance sr22 insurance coverage insurance insure

auto insurance sr22 insurance coverage insurance insure

https://www.youtube.com/embed/hbxoRP1aVE8

We hope this SR22 insurance overview helps you comprehend the situation far better than ever before (car insurance)., you can contrast SR22 insurance policy prices from dozens of business, assisting you discover the ideal bargain.